Project enquiry

Found a design you like or need custom guidance? We can help. Fill in the form about your project, and we’ll contact you to discuss options and answer questions.

Top 10 Modular Home Financing Options You Should Consider

When considering the journey of purchasing a modular home, understanding the financial landscape is paramount. According to renowned modular home financing expert, John Smith, "Navigating the financing options available for modular homes can be complex, but with the right knowledge, buyers can find solutions tailored to their unique situations." Modular home financing offers a variety of choices that cater to diverse financial backgrounds, making it a viable option for many potential homeowners.

In this exploration of the top ten modular home financing options, we will delve into the fundamental elements of securing financial support for your modular dwelling. Whether you are a first-time buyer or looking to refinance, the nuances of modular home financing are crucial in optimizing your investment. By understanding these options, you can make informed decisions that align with your financial goals and personal circumstances. As we outline these financing avenues, keep in mind that the modular home market presents distinct benefits that can enhance your living experience while maintaining financial viability.

Understanding Modular Home Financing: Key Concepts and Terms

When considering modular home financing, understanding key concepts and terms is essential. Modular homes typically require different types of financing compared to traditional homes, primarily due to their unique construction methods and potential costs. Familiarizing yourself with terms such as "permanent foundation" and "set-up costs" is crucial, as they impact loan eligibility and overall project expenses. Additionally, knowing the distinction between site-built and modular homes can help potential homeowners navigate financing options more effectively.

Tips: When exploring financing options, always inquire about the specific lending programs available for modular homes. Many lenders offer specialized loans that cater to the needs of modular home buyers, including FHA loans and USDA financing. Furthermore, it's beneficial to gather all necessary documentation upfront, such as income statements and credit reports, which can smooth the process and improve your chances of securing favorable terms.

Additionally, understanding the impact of credit scores on financing is vital. A higher credit score can lead to better interest rates and more accessible loan options. Prospective buyers should take time to check their credit reports for inaccuracies and consider improving their scores before applying for a loan. By being proactive about financial health, you can position yourself for a more successful modular home financing experience.

Types of Loans Available for Modular Home Purchases

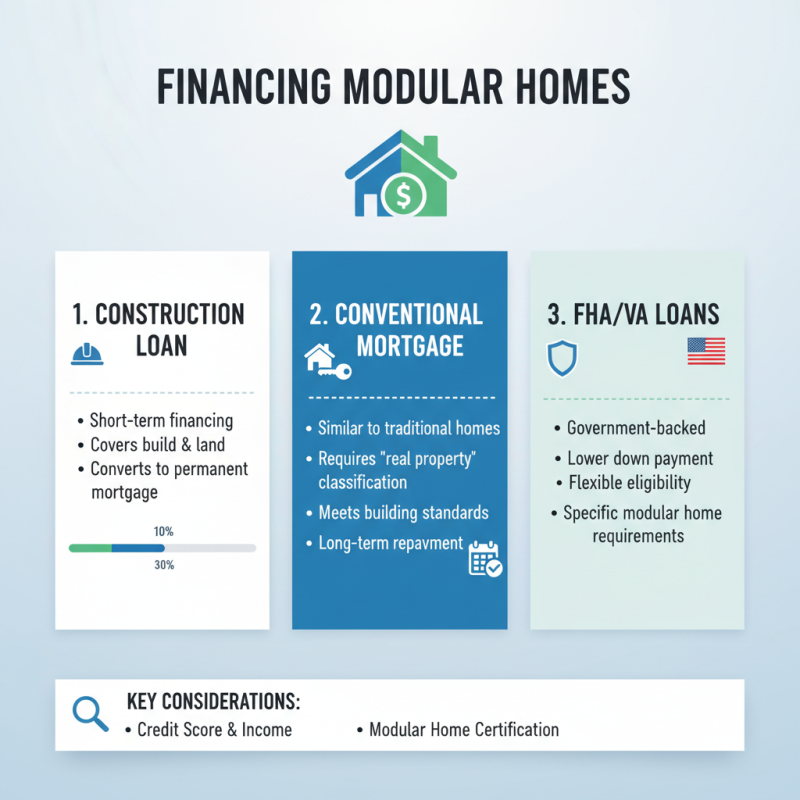

When considering financing options for modular homes, it's important to explore the various types of loans available to suit different financial situations. One primary option is a conventional mortgage, which operates similarly to traditional home loans but may require a slightly different qualification process due to the nature of modular homes. Borrowers typically need to ensure the home meets set standards and is classified as real property to secure this type of financing.

Another popular choice is a FHA loan, backed by the Federal Housing Administration, which offers lower down payment requirements and is more accessible for first-time homebuyers. This can be particularly beneficial for those who may not have significant savings. Additionally, VA loans provide options for veterans and active-duty military personnel, allowing them to purchase modular homes without a down payment, provided the home meets specific eligibility criteria. Understanding these financing avenues can empower prospective buyers to make informed decisions tailored to their financial needs.

Exploring Government Programs and Grants for Modular Homes

When considering modular home financing, exploring government programs and grants can unlock valuable funding opportunities. Many states offer programs aimed at assisting first-time homebuyers, which often include modular homes. These programs may provide down payment assistance, reduced interest rates, or even forgivable loans. Additionally, the Federal Housing Administration (FHA) offers loans specifically designed for modular and manufactured homes, making it easier to secure financing with lower down payments and flexible credit requirements.

Tips: Research specific state and local grants available for modular homes, as these can vary significantly by region. Additionally, consider reaching out to local housing authorities or non-profit organizations that specialize in homeownership assistance. They can provide guidance on which programs you qualify for and help with the application processes.

Another avenue to explore is energy efficiency grants, which are sometimes available for modular homes. These grants can help cover the costs of energy-efficient upgrades, ultimately resulting in lower utility bills. Many states participate in programs that incentivize the use of sustainable building materials and practices, allowing homeowners to benefit from significant savings in the long run.

Tips: Keep an eye out for federal tax credits related to energy efficiency; these can further enhance your budgeting for a modular home. Consulting with a financial advisor familiar with housing grants can also optimize your financing strategy, ensuring you make the most informed decisions.

Comparing Conventional Financing vs. Specialty Loans for Modular Homes

When it comes to financing modular homes, understanding the differences between conventional financing and specialty loans is crucial for potential homeowners. Conventional financing options typically involve traditional mortgages from banks and credit unions, which may not always cater specifically to modular homes. Lenders might treat modular homes as personal property rather than real estate, leading to challenges in securing favorable loan terms. Therefore, it’s essential to present the modular home on a permanent foundation, obtain appropriate appraisals, and ensure proper zoning to boost your chances of loan approval.

On the other hand, specialty loans are tailored specifically for modular homes, accommodating the unique aspects of their construction and financing needs. These loans may offer more flexible terms, including lower down payments and accommodating credit requirements. Additionally, some programs provide specific advantages for first-time homebuyers, making them an appealing choice.

Tip: Always compare interest rates and terms from multiple lenders to find the best deal. Moreover, be sure to assess your eligibility for government-backed loans, as they can provide significant financial incentives and support throughout the purchasing process. Remember to gather all necessary documentation beforehand to streamline the financing process.

Tips for Choosing the Right Lender for Your Modular Home Financing

When choosing a lender for your modular home financing, it is essential to assess several critical factors. First, consider the lender's experience with modular homes specifically. Not all lenders are familiar with the unique aspects of financing these types of homes, so selecting one that understands the distinctions is crucial. Look for lenders who have a track record of providing loans for modular homes, as they will be more equipped to offer advice and support tailored to your needs.

Moreover, evaluate the terms and conditions of the financing options available. Different lenders offer various interest rates, repayment periods, and down payment requirements. It’s essential to compare these carefully to find a plan that aligns with your financial situation.

Additionally, investigating customer reviews and testimonials can provide insights into the lender’s reliability and customer service. A lender who communicates clearly and is responsive to your inquiries will make the financing process smoother and less stressful. By thoroughly researching and comparing potential lenders, you’ll be better positioned to secure favorable financing for your modular home.

Related Posts

-

Top 10 Essential Tips for Modular Home Financing Success

-

Top 5 Kit Houses for 2025: Affordable and Stylish Living Solutions

-

Exploring the Future of Modular Cottage Homes: Sustainable Living and Design Trends

-

How to Choose the Best Modular Home Kits for Your Dream Home

-

Exploring the Rise of Prefab Homes as the Future of Affordable Housing Solutions

-

Top 10 Benefits of Choosing Fabricated Homes for Your Next Move